No one ever said that becoming a successful real estate investor was easy. It takes a lot of hard work, dedication, and knowledge to make it in this industry. However, with the right planning and foresight, you can build a profitable real estate portfolio that will set you up for success for years to come. In this blog post, we will discuss four important things to keep in mind when building your real estate investment portfolio!

Photo by Andrea Piacquadio from Pexels:

Find the best locations.

One of the most important things to consider when building your real estate portfolio is the location of the properties you invest in. You want to ensure you are investing in areas with a strong potential for growth and will be in high demand by renters or buyers. Doing your research ahead of time on locations will help ensure that you make wise investment decisions.

In addition to researching locations, it is also important to pay attention to trends within the real estate market. Staying up-to-date on industry news and changes will help you identify opportunities and make informed decisions about where to invest your money.

Of course, even with all of this research, there is always some risk involved in any real estate investment. However, being mindful of these things from the start can minimize your risk and increase your chances of success.

Choose the right property type.

Not all real estate is created equal, and it is important to pick the correct type of property to invest in based on your goals and needs. For instance, if you are looking for a steady income stream, you may want to invest in properties that can be easily rented out, such as apartments or single-family homes. Or, if you are looking to flip properties for a profit, you will want to focus on finding fixer-uppers that have the potential to be sold at a higher price point down the road.

No matter your goals, choosing properties that make sense for your portfolio and fit within your budget is crucial. Working with an experienced real estate agent can help you identify properties that meet your criteria and fit within your budget, making the investment process more straightforward and less stressful.

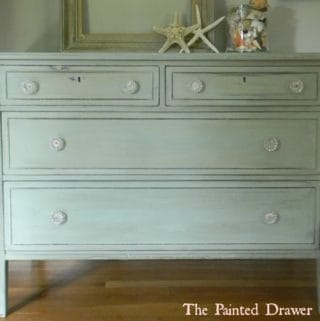

Plan for property maintenance.

Another vital thing to keep in mind when building your real estate portfolio is that properties will need to be maintained over time. This includes things like painting, repairs, and landscaping. While it is possible to do some of this work yourself, it is often best to hire a professional handyman to handle these tasks. Not only will this free up your time, but it will also ensure that the work is done properly and up to code.

In addition to property maintenance, you will also need to factor in the cost of insurance and taxes when budgeting for your real estate investments. These costs can add up quickly, so it is vital to be aware of them from the start. By planning for these expenses ahead of time, you can avoid any surprises down the road.

Have a diversified portfolio.

When it comes to real estate investing, it is essential to remember that diversification is key. You don’t want to put all of your eggs in one basket, so to speak. Instead, you want to spread your risk across a variety of different properties and locations. This way, if one property doesn’t perform as well as you had hoped, you will still have other investments working for you.

There are many different ways to diversify your portfolio, so it is important to find what works best for you and your goals. However, common methods include investing in different types of property (such as residential and commercial), investing in multiple locations, or even investing in various stages of the real estate cycle (such as pre-construction and resale).

These are just a few things to keep in mind when building your real estate portfolio. By researching, staying up to date on market trends, and diversifying your investments, you can minimize risk and increase your chances of success.

Please note that some of the links above and below are affiliate links, and at no additional cost to you. All opinions are my own.